We all get the impression that forex trading is unpredictable. It is to some extent, but that does not mean that you should guess and make trades blindly. All the forex trading assets are affected by various forces, and the information regarding them is available in world news. One concept in forex that can be used to inform your strategy is a correlation. This situation is where specific currency pairs have some relationship, and predicting one accurately can help you predict the other. This piece will expound on non correlated forex pairs and explain how they affect your strategy moving forward.

What is Forex Correlation?

This is a positive or negative relationship between different currency pairs.

Have you ever noticed two currency pairs that seem to follow the same trend, in that when one rises, the other one rises to an almost equal proportion? Have you also seen other currency pairs that seem to move opposite to each other proportionally?

This is what currency correlation is all about.

A positive correlation is where two currency pairs move in the same direction, whereas a negative correlation is where they move in opposite directions.

Correlation is an excellent tool for any forex trader as it allows them to reap more profits and reduce their risk exposure.

Note that forex correlation can be measured technically, and here, you will understand how much each currency pairs are related and to what degree they might be in tandem with each other.

Note that correlation is not cast on stone and the forex market has the same degree of volatility you have come to know about it. This way, correlation is simply a guide on how specific pairs might move in regards to each other, but anything can happen and break this relationship.

Understanding the Technical Aspects of Correlation

To understand the relationship between currency pairs, you will have to check their correlation coefficient. It is a figure that falls between a scale of negative to positive one.

+1 is regarded as a perfect positive correlation, which shows that the two pairs are proportionally related and will move in the same direction all the time. This rarely happens.

-1 is a perfect negative correlation, which implies that the two pairs will move in the opposite direction all the time.

A correlation efficient of 0 shows that the two currency pairs have no correlation, and they are independent of each other. These are what we call non correlated forex pairs, and no trader, no matter how experienced or knowledgeable, they are can predict how one will move on account of the other.

Naturally, there is more risk involved when trading such pairs.

Where Do I Find Correlation Coefficient?

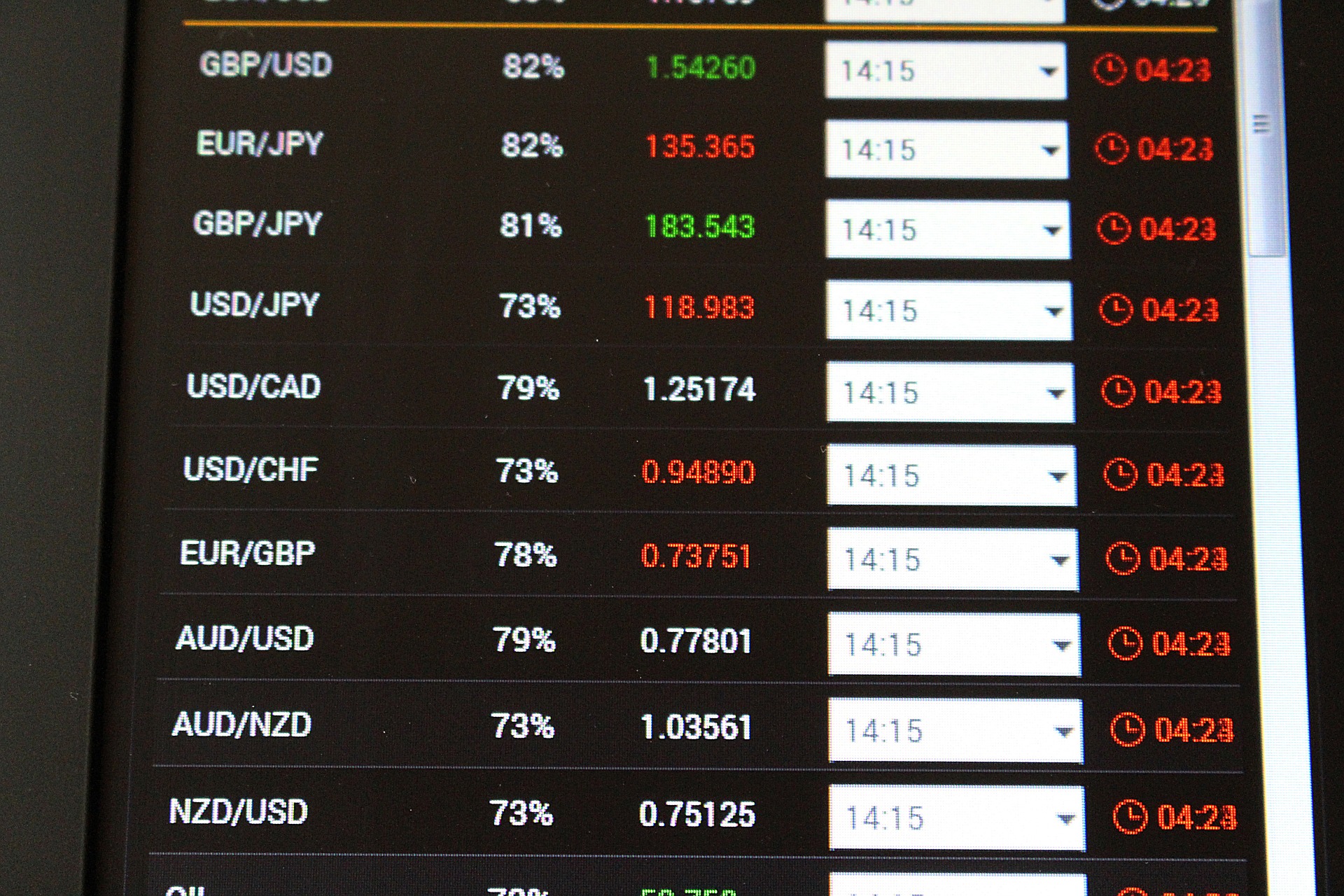

Unless you have the skills needed to calculate correlation on excel, you might be better off seeking this information from your forex software. Most of them have tables showing a correlation between common currency pairs, and this is an easy way to use them for your trading strategy.

You will find a positive correlation displayed as a figure with no sign and negative with the minus sign. Some have color-coding with negatives in red and positives in a green.

Note that the correlation scale is a sliding one, and as the number or shade of color moves from positive to negative, the less or opposite a currency pair is related. It is vital to understand these figures as they have a significant impact on trading decisions.

How Can Non Corelated Forex Pairs Help My Strategy?

Are you already wondering how all this technical stuff will help you make profits? We will break it down here.

One recommended way to avoid taking big hits in forex trading is diversifying risk, right?

Typically, you would want to trade in different currency pairs so that when one takes a sudden nosedive, you can still recover money from another. Correlation gives you an information platform that you can use to decide which currency pairs will help you diversify risk.

In the absence of correlation, you can trade two currency pairs with the impression that you are diversifying your investment when they are positively correlated. This way, if one takes a nosedive, your entire investment will go down the drain.

When trading non correlated forex pairs, that is, ones with zero correlation, you will need to do it independently or using other sources of information. This is because these pairs move independently, and you cannot anticipate the turn they will take.

Here, you will be exposed to greater risk, and you should be prepared for it.

Lastly, the correlation will help you avoid situations that cancel each other. If you invest in pairs that are negatively correlated, they will cancel each other and get you back to where you are.

Bottomline

Correlation is an essential concept in forex trading and can help you to hedge or diversify your exposure in the market. It gives you a basis for reference when trading currency pairs and will guide you to make informed decisions rather than relying on guesswork.

The information regarding the correlation between different currencies is available online, and if you have a bias towards one, then you could use it as a basis to trade in the other. Non correlated forex pairs are riskier but can still be part of your strategy if you want to avoid instances where you take a double hit.