A popular saying on the markets is that, without leverage, nobody will trade forex. The roots of this saying are found in equities, where margin trading started. Usually, a stockbroker gives you credit against your stocks. You need just 50 to 60% for buying equities if you leave your stocks in lien for your broker. And, of course, you pay interest for money they lent you. Not a bad deal if markets go up. But, a very bad idea if markets go down, because you lose twice as fast as you expected. In cases where you have not used a margin, you are able to withstand any market crash, unless your company goes bankrupt and you only invested money you really did not need. That is investing. You invest the money you can afford to lose. If you buy equities, that is safe. But, if you buy equities on a margin, you can lose even more than your investment. Imagine a market fall like that of 2001, when the Twin Towers fell. Prices went down so quickly that you were not able to fulfill stop-loss orders at set values. And, while the usual margin on equities is one to two (or 50%), forex guys usually start with a leverage of one to 10 (10%). And, to be clear, nobody chooses a broker with a 10% leverage. You can find one to 50 with no effort, while a net leverage of one to 100 is possible if you spend a little more time looking. That is 1%. So, with your USD 1,000, you make USD 100,000 in trade. Crazy.

Only bonds trading is done without leverage. And probably that is the reason why no retail trader is doing it. As we mentioned, there is something boring about buying and holding onto maturity. Besides, you have to really spend USD 100,000 to purchase a USD 100,000 bond. That is even more boring and such a long way off from earning a few percent in interest. So, nobody is doing that.

There is a general understanding that you cannot lose more than you invest. But, that is a general misunderstanding about the markets. Every broker uses fine print in their business conditions. You can lose more than you deposit or invest. And you should keep this in your mind when you are trading on leverage. There is no safety net, there is no insurance against losing everything you have once you are trading on leverage. Leverage really can destroy your financial health.

Stories from TradeFloor:

On January 15, 2015, the Swiss National Bank (SNB) did a great job in reminding all investors, gamblers and players on forex markets that leverage can lead you towards bankruptcy. Here is the story of the most recent market burst, which happened just a few months ago.

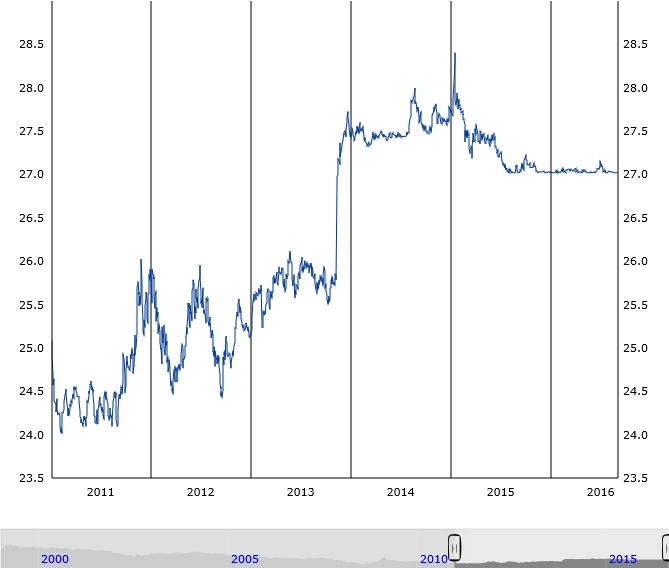

Tuesday, September 6, 2011, was the day when the SNB stunned the market by setting an official floor on the EUR/CHF rate at 1.2000, which as the bank officially stated will be maintained with the utmost determination. On that Tuesday, the Swiss franc depreciated by approximately 8.2% against the euro. There were several losses on markets that day. But, as markets do not have elephant memories, everyone had forgotten what had happened a few months later. And a lot of players tried to earn on the SNB floor. When the rate reached 1.2000, a lot of traders bought the euro against the Swiss franc, then waited until someone from the SNB verbally intervened and moved the cross-rate higher. This way of life and making profits came to end three years and four months later. Thursday, January 15, 2015 was the day when many traders learnt that leverage is king: the king of loss. On that day at 08.30 GMT, the SNB shocked the markets with the announcement that it was to abandon the EUR/CHF floor policy and let the market freely decide what the rate should be. Nobody expected this, because, even a few days earlier, the SNB had reiterated its commitment to maintaining the floor with the utmost determination. (Well, someone probably knew that. Until now, however, nobody knows who benefited from this shocking announcement, but time will reveal all.) At 08.31 GMT on the same day, the EUR/CHF market ceased to exist. Nobody was quoting prices, nobody knew where the market price was. After a 45 long minutes, the first prices showed up on the screens at around 9.15 GMT, initially around 1.01, then 0.98, followed by 0.96 and then falling right away to an all-time low of 0.85. (Later that day, the price stabilized around 1.03 before it fell again to 0.98. A few days later, the market price was at 1.05). These 45 long minutes taught the market a lesson. Stop-losses set close to 1.2000 were absolutely useless. A stop-loss order is an order whereby, after reaching the stop-loss price, an order is filled with the price indicated on the market. In this particular scenario, all stops were filled around 1.03 and lower. And that is an absolute catastrophe for all leverage traders. If you traded with a leverage of 2% and only kept EUR 2,000 for your EUR 100,000 trade open at 1.2000, you would have lost 20% with a stop-loss order filled at 1.000. So, a leverage trader with a EUR 20,000 loss and only EUR 2,000 on account would have definitely owed his broker EUR 18,000 EUR: nine times his initial deposit. If a trader had played with more money and without any reserve, he would have had an even bigger problem. Published losses of individual traders were around EUR 100,000 to EUR 200,000 with the same amounts owed to brokers. Years of legal battles lie ahead for many retail traders. Were any lessons learned? A lot of brokers now offer leverage at just 5% and more. But, be sure that, within a few months, the market will forget what happened and leverage at 2% and less will be available again. Traders also learned a lesson: you can never rely on thatyou cannot afford to lose more on than your initial deposit, because you can. You always have to think about the worst-case scenario. So, the brighter ones only trade in relation to limited liability companies. Even if they lose more than their deposit, the company will go bankrupt, not themselves.

Read more here: